36+ is mortgage interest tax deductable

Homeowners who bought houses before. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Rethinking Tax Benefits For Home Owners National Affairs

Web For tax years before 2018 the interest paid on up to 1 million of acquisition indebtedness is deductible if you itemize deductions.

. There is no deduction for mortgage interest on a Massachusetts Tax Return. See If You Qualify To File 100 Free w Expert Help. Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return.

This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. This means foregoing the standard deduction for your filing status which is pretty. We dont make judgments or prescribe specific policies.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of. Our Tax Experts Will Help You File Fed and State Returns - All Free.

Ad File 1040ez Free today for a faster refund. Also if your mortgage balance is. Web You cant deduct home mortgage interest unless the following conditions are met.

A borrowing expense that a taxpayer can claim on a federal or state tax return to reduce taxable income. States that assess an. See what makes us different.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web The mortgage interest tax deduction is a tax benefit available to homeowners who itemize their federal income tax deductions. Ad For Simple Returns Only.

16 2017 then its tax-deductible on. Web Tax Deductible Interest. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Web For tax year 2022 what you file in early 2023 the standard deduction is 12950 for single filers 25900 for joint filers and 19400 for heads of household. Web Some tax-deductible interest must be claimed as an itemized deduction. February 23 2021 656 AM.

Web 1 Best answer. The good news if you have a bigger mortgage is. You file Form 1040 or 1040-SR and itemize deductions on Schedule A Form 1040.

Our Tax Experts Will Help You File Fed and State Returns - All Free. See If You Qualify To File 100 Free w Expert Help. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes. Web 2 days agoThe interest on the home equity loan would be deductible assuming your total loan balance on both your first mortgage and this home equity loan is no more than. Ad For Simple Returns Only.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. The amount you can deduct is limited but it can be. The interest on an additional.

Types of interest that are tax. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. If you are single or married and.

Web You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately. 13 1987 your mortgage interest is fully tax deductible without limits. Web Most homeowners can deduct all of their mortgage interest.

Web If you took out your mortgage on or before Oct. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Business Succession Planning And Exit Strategies For The Closely Held

:max_bytes(150000):strip_icc()/InterestDeductions-0c6d98dac2c64b9a93c07d8078ae5fdd.jpg)

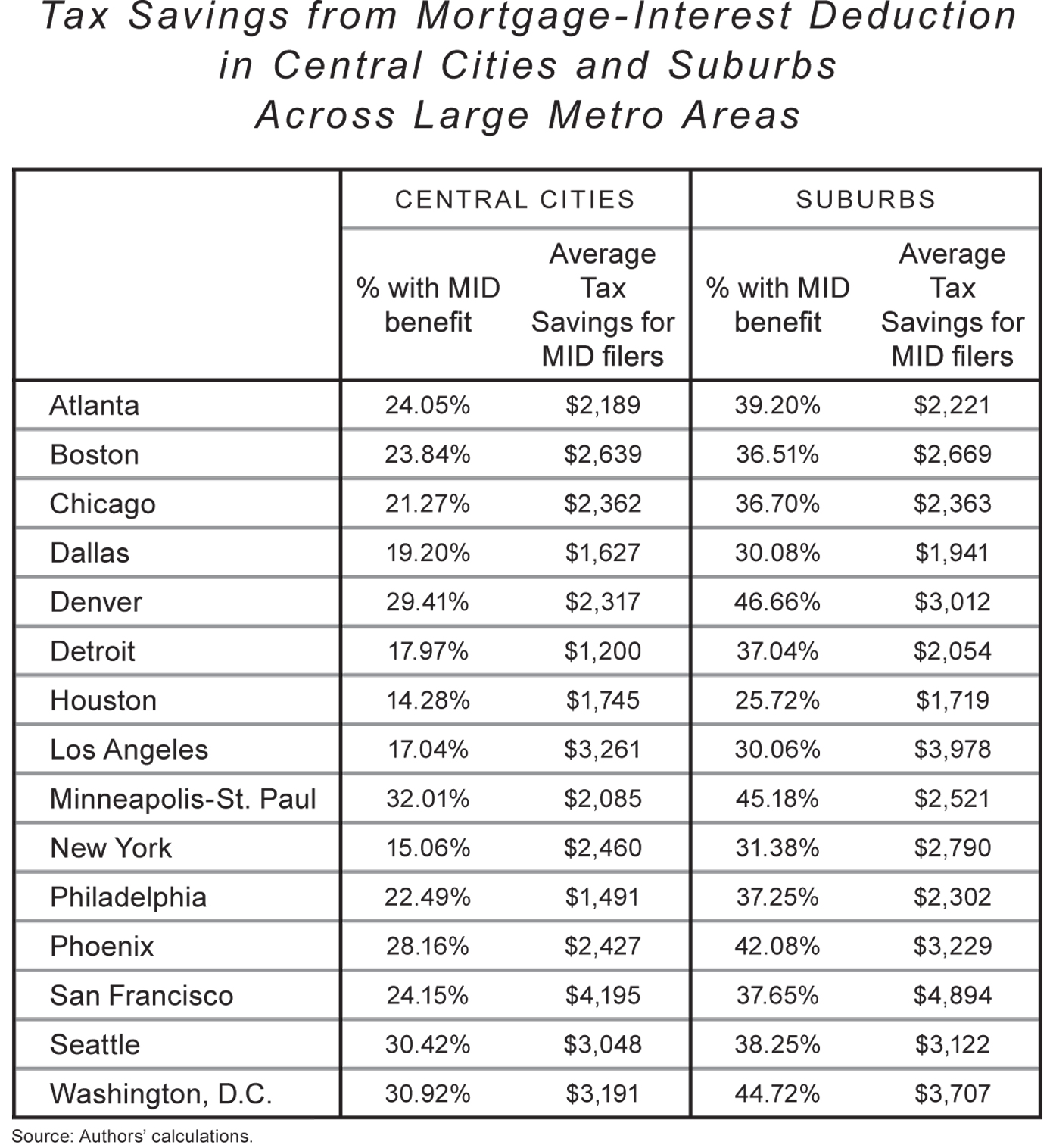

Calculating The Home Mortgage Interest Deduction Hmid

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Valuation Of Mortgage Interest Deductibility Under Uncertainty An Option Pricing Approach Sciencedirect

Mortgage Interest Deduction How It Calculate Tax Savings

Calculating The Home Mortgage Interest Deduction Hmid

Innovative Proptech Companies By Proptech Switzerland Issuu

Yerli Otomobilde Yeni Gelisme Izin Yolu Gurbetciler

Mortgage Interest Tax Deduction What Is It How Is It Used

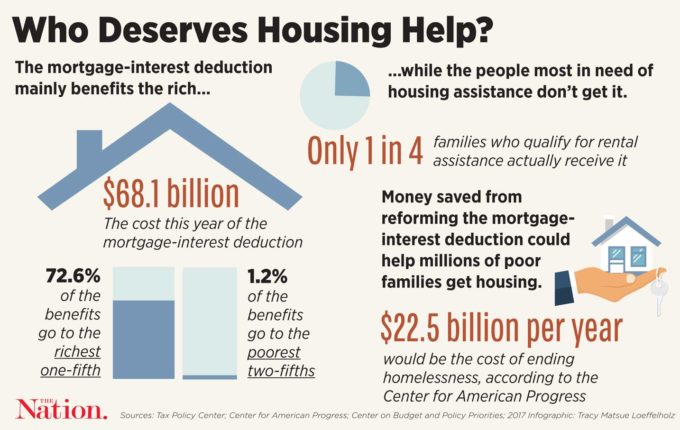

Long Sacrosanct The Mortgage Interest Deduction Comes Under Scrutiny The Nation

Mortgage Interest Deduction Bankrate

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Bankrate

Where Oh Where To Deduct Mortgage Interest U Of I Tax School